Update on Market Discount Rates as at 31 December 2021

With the uncertainty created by COVID-19 continuing to impact businesses and markets, the selection of a reasonable discount rate remains a key consideration, whether for the purpose of financial reporting or for broader valuation requirements.

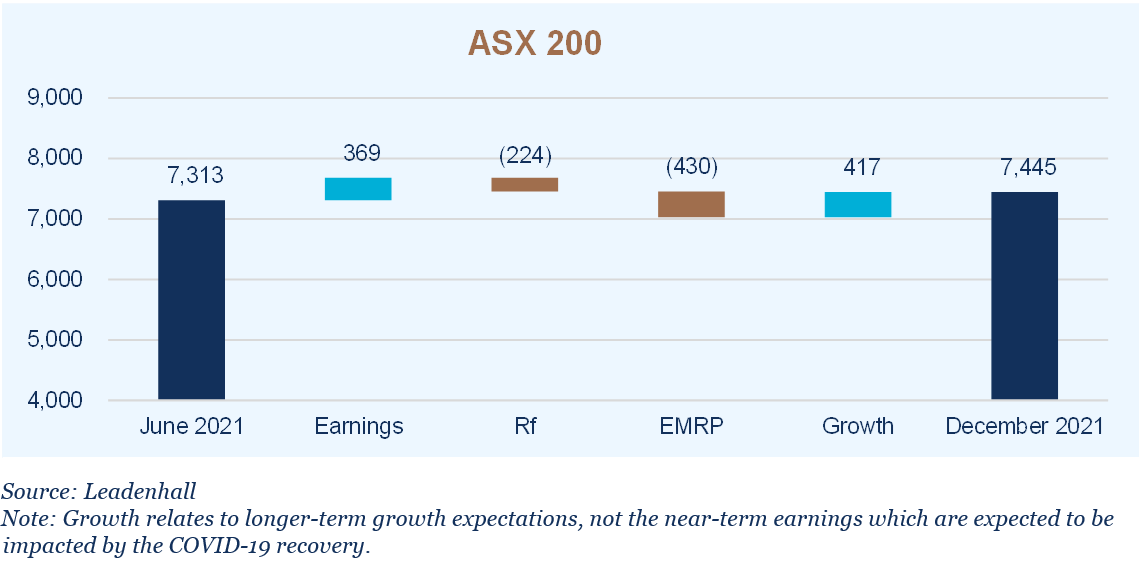

The following chart presents a summary of the overall change in our assessment of the weighted average cost of capital (WACC) for the market as a whole from 30 June 2021 to 31 December 2021.

Market discount rates have risen

Source: Leadenhall

Note: Movement in WACC is for the overall market and is not company specific

The cost of capital has increased over the period due to a rise in both the risk-free rate and the equity market risk premium (EMRP). All other things being equal, this will lead to lower asset values.

The impact of COVID-19 does not alter the best practice approach of using expected cash flows as the basis for valuations. In fact, the greater uncertainty associated with future earnings indicates that additional rigour may be required in developing robust projections. These forecasts should be coupled with an appropriate discount rate calculated using post COVID-19 inputs.

“… spending is bouncing back quickly, especially on services. The Omicron outbreak does, though, represent a downside risk and it is difficult to know how things will develop from here.”

– Philip Lowe, RBA Governor – The RBA and the Australian Economy, Address to CPA Australia Riverina Forum

“COVID-19 conditions have continued through 2021 and companies will be affected differently depending on their industry, where they operate, how their suppliers and customers are affected, and a range of other factors. The changing environment in which each company operates will affect its strategies and its assumptions about the future performance of its assets and businesses.”

– ASIC – focus areas for 31 December 2021 financial reports under COVID-19 conditions

As recognised experts, this update helps you understand the assumptions we make which you can rely on for a reasonable outcome.

Leadenhall Solution: It is important to understand and be able to justify the assumptions that support your projected cash flows and WACC as well as ensuring cross-checks to market metrics (such as market capitalisation and EBIT multiples) are undertaken where observable. Leadenhall can assist with this analysis.

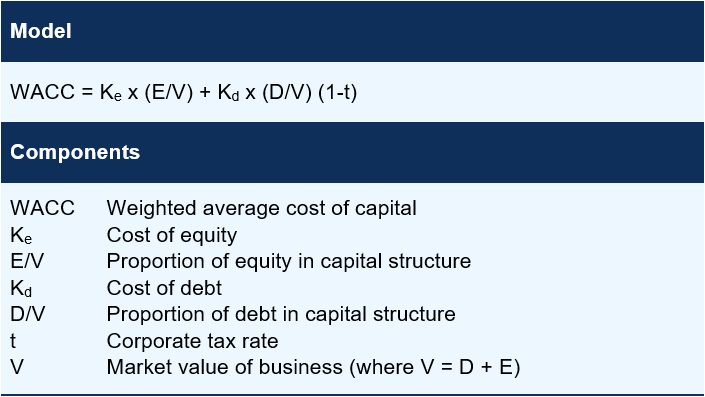

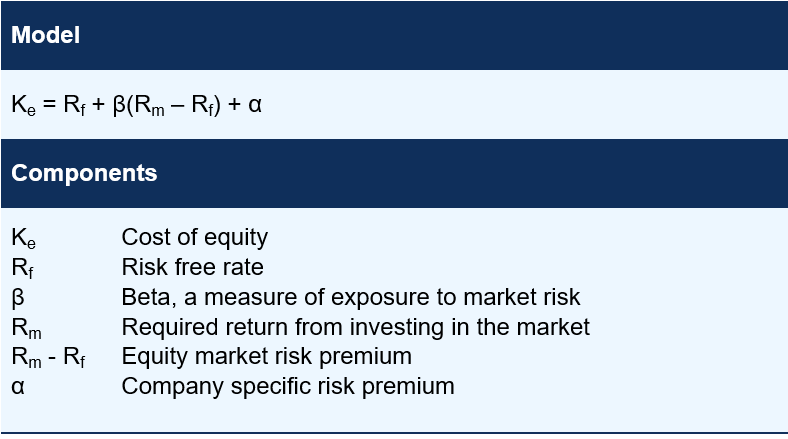

Framework

We have used the standard WACC and capital asset pricing model formulae.

Weighted Average Cost of Capital

Capital Asset Pricing Model

Application to specific businesses

Determining an appropriate discount rate to apply to a specific business may require consideration of variables and risks unique to that business. This may be addressed through the inclusion of a company specific risk premium in the discount rate.

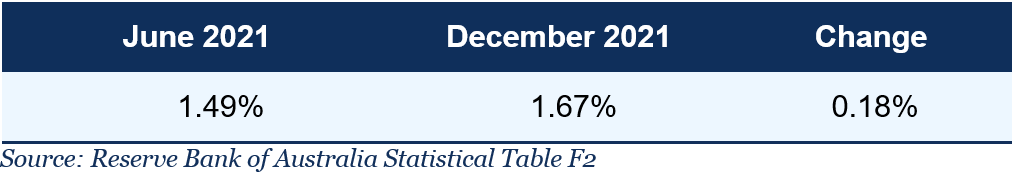

Selecting the risk-free rate (Rf)

The risk-free rate should be in the same currency as the asset being valued and its maturity should match the life of the investment. In Australia, the most common proxy for the long-term risk-free rate is the yield on ten-year Commonwealth Government bonds which have been as follows:

Risk-free rates remain close to historical lows

The rise in government bond yields since June 2021 may result in an increase in overall discount rates, all other things being equal.

Risk-free rates remain at historically low levels. Rather than adopting current market observed risk-free rates, some valuers are adjusting observed risk-free rates to reflect a long-term average rate. However, some of these valuers are then not adjusting other parameters accordingly – leading to inconsistent and unreliable discount rate conclusions.

Leadenhall Solution: We avoid the dangers of normalising by using market observed risk-free rates coupled with a contemporaneous assessment of the EMRP. This better reflects the current views implicit in capital markets and responds more quickly to changes in market pricing.

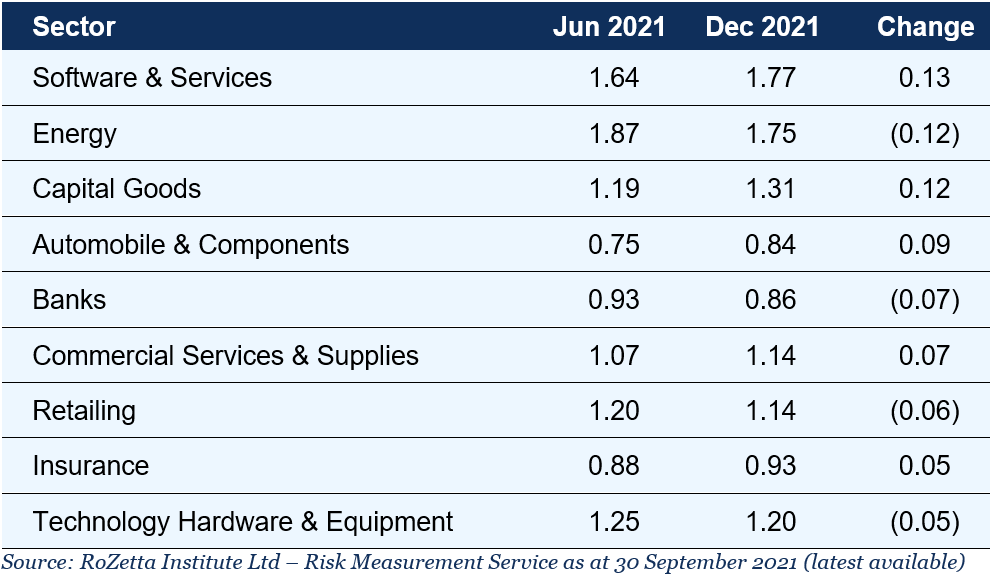

Assessing Beta (β)

Beta is a measure of the relative riskiness of a business compared to the market as a whole. An appropriate beta needs to be selected for each cash generating unit (CGU) or business segment, based on the relative riskiness of that business.

Observed industry betas have remained broadly unchanged

There have been minimal changes over the past six months and, out of 24 discrete industries reported, only the 9 industries above showed a change in the observed beta of 0.05 or greater.

In our view, COVID-19 is not a beta issue. It has not impacted industries in proportion to their betas and there is presently no reason to expect underlying beta has changed for any specific industry. The incidence of COVID-19 will introduce significant noise into beta estimation. We are therefore excluding the share price volatility created by COVID-19 during March and April 2020 when estimating beta.

Leadenhall Solution: Rather than simply adopting an industry beta, we recommend undertaking a detailed analysis of the companies in a sector that have comparable risk to the business being valued. The betas for comparable companies should be based on data up to 31 December 2021 and generally need to be ‘ungeared’ to remove the impact of actual debt levels and then ‘re-geared’ to the optimal debt level (which is not necessarily the actual debt level) of the business being valued.

Cost of debt (Kd)

The cost of debt is generally related to the risk-free rate, with the difference being a credit spread. The following table shows that corporate lending rates have risen more than risk-free rates (indicating a slight widening of the credit spread) since June 2021. This is based on the yields of BBB-rated corporate bonds.

Lending rates remain low

Leadenhall Solution: Instead of historical borrowing costs, the cost of debt should be based on the current borrowing cost – as if the business were to be refinanced in the current market at ‘optimal’ gearing levels.

Increase in market risk premium

Equity market movements can be broken down into changes in earnings, changes in growth expectations and changes in discount rates. We then disaggregate the change in discount rates into movements in the risk-free rate, debt levels and movements in the market risk premium in the following charts.

Increase in the implied EMRP

The chart presented above shows an increase in the index predominantly driven by an expected recovery in forecast earnings in the short-term and greater optimism around long-term growth, offset somewhat by an increase in both the risk-free rate and the EMRP since June 2021.

Leadenhall Solution: We have increased our assessment of the EMRP from 6.5% at 30 June 2021 to 6.75% at 31 December 2021. This reflects the moderating impact of the EMRP on growth in market indices, despite an improving economic outlook and stronger growth expectations.

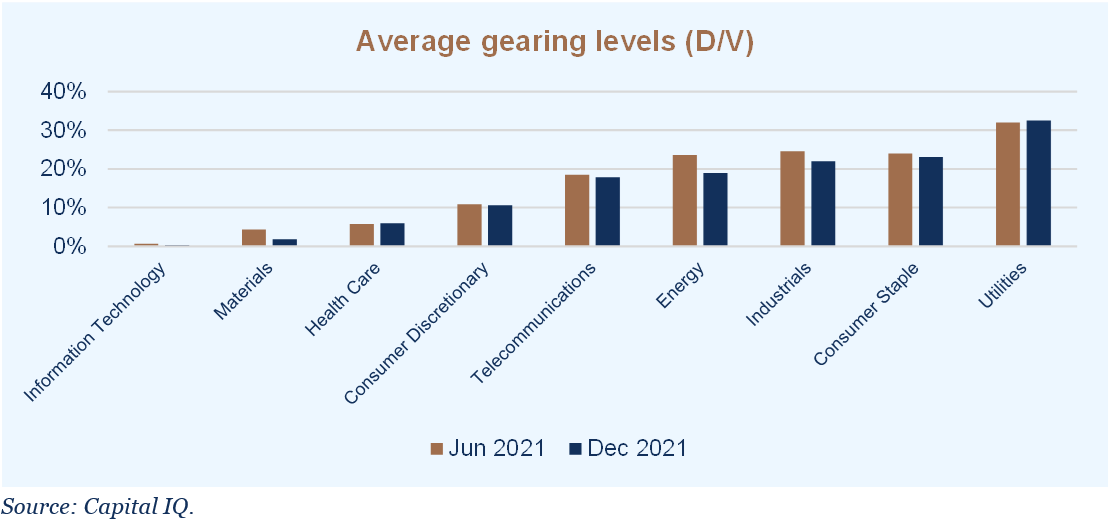

Capital structure

Debt levels across industries have declined on average over the past six months. A potential decline in optimal gearing may impact (increase) your discount rate, all other things being equal.

Average gearing levels have declined slightly

Leadenhall Solution: As with the cost of debt, the proportion of debt used in the calculation of WACC should be based on an optimal capital structure. This is not necessarily the actual level of debt in the company or the average observed in an industry at any particular point in time. The efficient or optimal level of debt included in a discount rate should be an assessment of the level of debt that can be sustained by the specific business or CGU over the medium to long term.

The apparent decline in gearing levels was anticipated in our previous analyses of market discount rates. The effects of COVID-19 on borrowing capacity and the ongoing recovery in markets has, on average, reduced the relative proportion of debt in companies. As we had already reflected a decline in gearing levels in our previous assessments of market discount rates, no further adjustments are required.

Our other concerns that may attract attention

Given the impact of the COVID-19 response on economic activity and the heightened uncertainty around future earnings and cash flows, emphasis should be placed not only on the discount rates adopted but on the preparation of robust cash flow projections. Some common issues we have observed are:

- Optimistic forecasts with insufficient allowance for capital investment and / or time to recovery

- Inconsistencies between the discount rate and cash flows

- Relying on a single valuation methodology without considering any cross-checks.

Our difference

Leadenhall doesn’t just offer thought leadership; it prides itself on knowledge delivery. Reports such as these contain the most recent, relevant information available, clearly presented to go beyond the maths and provide you with a deeper understanding of the critical issues.

This analysis is updated regularly throughout the year with reports issued in December and June in line with full year and half year reporting for most Australian companies. Discount rates herein are expressed in nominal post-tax terms1.

1Accounting standard AASB 136 – Impairment of Assets requires value in use to be assessed with a pre-tax discount rate (paragraph 55). However, market practice in Australia is to perform this analysis using a post-tax discount rate (and post-tax cash flows), with the implied pre-tax discount rate being disclosed in the financial statements.

Click here to download this update.

Questions?

For further information on selecting an appropriate discount rate for your company or cash generating units please feel free to contact us.