We recently valued an unsecured debt instrument issued by a large European infrastructure asset owner on behalf of a number of Australian superannuation funds. As infrastructure instruments (both debt and equity) are an emerging asset class for a range of investors, we thought it would be useful to share some of our insights on recent trends and issues from an investment perspective.

Introduction and context

The predictable cash distribution yields, relative stability of capital invested and low correlation with other asset classes are the attributes typically provided by infrastructure assets that are coveted by investors. The demand for these assets has grown significantly against the backdrop of volatile capital markets and western governments increasingly looking to the private sector to help fund new projects and/or fill budget holes through infrastructure privatisations.

This trend will continue as cumulative global infrastructure spending through 2030 is expected to be $41 trillion. This investment is expected from both replacement of aging infrastructure in developed countries and new infrastructure being built in developing countries. Budget deficits in most OECD countries for at least the near term will make alternative business models, such as public-private partnerships, increasingly common.

Recent investment trends

Infrastructure investments held by institutional investors have risen from around US$160 billion in 2010 to approximately US$300 billion at the end of 2014 according to Preqin. In addition there is somewhere between US$100 billion to US$200 billion in undeployed capital (or ‘dry powder’) in the sector.

This supply and demand imbalance for infrastructure investments has resulted in high levels of contestability for most sales processes in the sector, particularly large scale ‘core’ infrastructure such as ports, airports, toll-roads and utilities.

Headline prices for infrastructure assets, in terms of historical earnings before interest and taxes (“EBITDA”) multiples, suggest a rise in the prices paid for core infrastructure assets in recent years. However, using a single multiple as a measure of value for these types of assets is often crude, particularly as these multiples often don’t account for differing concession terms, impact of growth plans, funding structure and other earnings improvements. In any event, in our experience and based on anecdotal discussions, the lack of sufficient investable assets in the sector is clearly resulting in some investors accepting lower returns than previously was the case in order to secure assets.

As some of these auction processes are being won or lost based on ‘a cost of capital shootout’, some infrastructure investors are looking further up the capital structure to debt and/or hybrid instruments to obtain exposure to the same asset at what they consider to be preferable risk-adjusted returns.

Debt securities for core infrastructure assets can provide pre-tax returns in the order of up to 8% (depending on the asset class, jurisdiction issued and level of subordination) and potentially higher for mezzazine debt. In addition, debt investments typically have lower origination costs (in terms of advisers, due diligence costs, etc.) and ongoing asset management costs relative to equity investments.

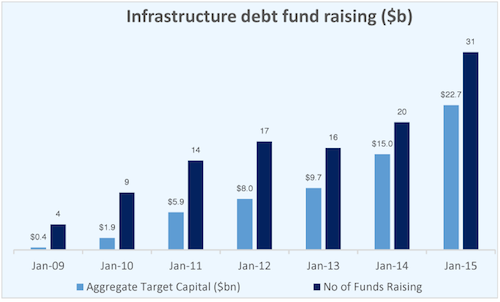

Infrastructure debt is a relatively new asset class for a number of investors as can be seen by the significant increase in capital raised for the asset class from US$0.4 billion in 2009 to US$22.7 billion in 2015 highlighted in the chart below: Source: Preqin

Source: Preqin

2015 represented a record year in terms of number of funds raising capital (31) and the amount of capital targeted by these investors (US$22.7 billion).

Infrastructure debt vs equity

Since infrastructure assets have revenues that are typically contractual, part of a unique concession or derived in a monopoly/oligopoly environment and costs which are reasonably well known, the cash flow profile is relatively predictability and acts as security for lenders. As a result lenders are usually willing to fund anywhere between 30% to 80% of the asset value (compared to 0% to 40% for typical operating businesses).

The investment characteristics, risk assessment and due diligence process for evaluating a debt investment in an infrastructure asset involves a number of similar skill sets, processes and analysis as evaluating an equity investment in the asset. Key differentiating factors in evaluating debt investments include:

- Subordination: Infrastructure debt can be classified as senior or subordinated. Subordinated debt ranks behind senior debt and ahead of equity in a company’s capital structure and will generally offer investors a return which represents a premium to senior debt and a discount to equity

- Cash flow profile and investor returns: debt investors will have a fixed return or coupon (which may represent a fixed margin to an underlying base interest rates) whereas returns to equity holders are dependent on business performance and/or available funding for distributions

- Covenants and security: debt investors have enhanced security over their return through covenants. Covenants for infrastructure assets can vary significantly across and within asset classes but are typically cash flow based such as debt service coverage ratio (DSCR) and loan life coverage ratio (LLCR). Most lenders will have a lock-up threshold (at which point equity distributions and other discretionary payments are no longer able to be made until debt service obligations are up to date) and a default threshold (at which point debt holders may have step-in rights and can either renegotiate the terms of the facilitate or instigate a process to recover their debt)

- Duration: debt financing is generally for a term that is less than the concession/life of the asset. Depending on the terms and conditions of the debt funding, there may be an opportunity to repay the facility early (which creates reinvestment risk for the holder). However, most infrastructure debt instruments would have fees/penalties for this to compensate investors for the lost returns

- Other features: infrastructure debt may have other features such as conversion options and ratchet provisions

- Liquidity: whilst some corporate and infrastructure debt can trade on listed markets, there is typically no active market for these securities. However, the investor pool for debt investment is more shallow than equities, although this pool is growing rapidly as discussed above.

Infrastructure debt typically follows a project finance structure whereby the only recourse is to the assets or cash flows of the project. This is distinct from other corporate debt which may be secured by the general assets or creditworthiness of the asset owner or borrower. Furthermore, corporate debt also tends to be more standardised in respect of covenants and other terms and conditions which results in deeper investor pools and more liquidity.

Valuation and other issues

Generally speaking, valuing debt securities is more straightforward than valuing equity securities as bonds typically have a finite life and more predictable cash flows in the form of a fixed coupon.

The value of a debt security is usually estimated by using variations of a discounted cash flow (DCF) approach. The DCF approach estimates the value of a security as the present value of all future cash flows that the investor expects to receive from the security. The cash flows for a debt security are typically the future coupon payments and the final principal payment. Provided the borrower is servicing the debt (and will continue to do so), the value of a bond is the present value of the future coupon payments and the final principal payment expected from the bond. This valuation approach relies on an analysis of the investment fundamentals and characteristics of the issuer. The analysis includes an estimate of the probability of receiving the promised cash flows and an establishment of the appropriate discount rate. In respect of debt instruments, the discount rate is derived by estimating an appropriate yield to maturity taking into consideration changes in market yields as well as company-specific risk factors such as credit risk.

Other approaches may also be considered when valuing infrastructure debt which include monte-carlo and other approaches which more explicitly consider any optionality and/or default risk associated with the security.

If a borrower is in breach of the covenants, or there is a risk of doing so in the future, analysing the probability of default and valuation of the underlying security is then required which then becomes more similar to an equity valuation.

From a practical perspective, some of the challenges in valuing infrastructure debt include:

- Ratings: the rating assigned to a debt security provides guidance on the appropriate yield/price although other factors such as security and industry sector impact this as well. Unlisted debt instruments are usually not rated by ratings agencies. Whilst it is possible to undertake a shadow rating analysis based on the criteria used by rating agencies to estimate the rating (or range of ratings) which may be applicable, this can be a subjective and time consuming exercise

- Other features: the key terms for each infrastructure debt facility may vary significantly as these are not standardised and are therefore commercially negotiated in each instance. Consequently, there may be other features that impact on the value of the instrument that need to be considered such as conversion options, non-callable periods and step-in rights

- Comparable market data: in part due to the absence of ratings in most instances as well as the bespoke terms which may be negotiated for an individual instrument, finding comparable issuances to observe value/pricing metrics such as margins and yield to maturity can be difficult, particularly for subordinated instruments. However, as more capital is deployed into the sector, the availability of comparable data should improve

- Analysis of security: as lenders typically only have recourse to the cash flows of the asset/project, understanding the loan to value ratio requires a contemporary analysis of the value of the asset in total. For assets that have high levels of tangible asset backing and observable secondary markets for the underlying assets (such as pipelines and rolling stock fleets) valuing the security of the underlying assets may provide an indication of the security available. However, as in other instances this often requires a detailed valuation analysis for the business as a whole in order to understand the level of security

- Impact of regulation: infrastructure assets may be subject to different regulatory regimes. These regimes are broadly classified as regulated, partially regulated or unregulated. For regulated assets it is important to understand the frequency and potential impact of future regulatory price resets as well as any implicit assumptions in respect of funding costs and/or gearing as these may diverge from commercial expectations.

Conclusion

Unlisted infrastructure debt and hybrid instruments are becoming a more common feature of infrastructure investors’ portfolios, particularly as competitive tension for core infrastructure equity investments remains elevated.

Valuing unlisted infrastructure debt instruments can be complex and will likely continue to become more complex as additional investors enter to the sector and demand bespoke features as part of the commercial negotiation of these transactions.

The valuation of infrastructure debt instruments often involves many similar aspects to valuing the underlying equity investment. As with equity valuations, there will be continued scrutiny from regulators, investors, trustees, auditors and other stakeholders on the valuation of unlisted debt instruments. Thus, ensuring a robust valuation process is undertaken and properly documented will be critical.