Market discount rate update - introduction

Markets have been volatile over the last month with uncertainty surrounding the global banking system and the broader economy, alongside inflation and recession concerns. With market conditions continuing to evolve rapidly, we have provided an update on our assessment of discount rates as at 31 March 2023.

After a period of volatility, the ASX200 ended the month of March 2023 slightly higher than 31 December 2022. With a sharp decline in the 10-year Commonwealth government bond yield (by approximately 75 bps) over the period, this implies an increase in the equity market risk premium for Australia.

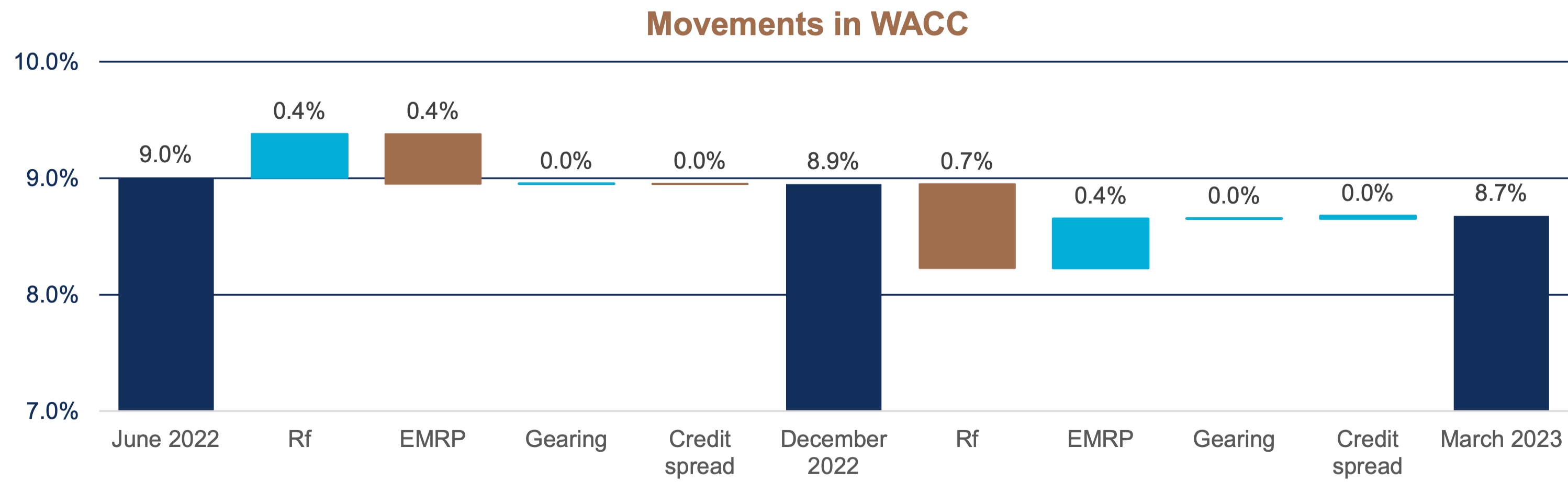

The impact of these changes on overall market discount rates is presented below.

DECLINING MARKET DISCOUNT RATES

Source: Leadenhall

Note: Movement in WACC is for the overall market and is not company specific.

“Global inflation remains very high. In headline terms it is moderating, although services price inflation remains high in many economies.

The outlook for the global economy remains subdued, with below-average growth expected this year and next. The recent banking system problems in the United States and Switzerland have resulted in volatility in financial markets and a reassessment of the outlook for global interest rates. These problems are also expected to lead to tighter financial conditions, which would be an additional headwind for the global economy”Philip Lowe, RBA Governor

Whilst recent market pessimism has increased the implied market risk premium, overall market discount rates remain lower compared to December 2022, largely due to declining bond yields.

Companies should consider the impact of the change in discount rates will have on their valuations, whether on their investment decisions or for impairment testing.

For further information on selecting an appropriate discount rate for your company please free to call us.

Our difference

Our difference

Our difference

Leadenhall doesn’t just offer thought leadership; it prides itself on knowledge delivery. Reports such as these contain the most recent, relevant information available, clearly presented to go beyond the maths and provide you with a deeper understanding of the critical issues. This analysis is updated regularly throughout the year with reports issued in December and June in line with full year and half year reporting for most Australian companies. Discount rates herein are expressed in nominal post-tax terms.1

1 Accounting standard AASB 136 – Impairment of Assets requires value in use to be assessed with a pre-tax discount rate (paragraph 55). However, market practice in Australia is to perform this analysis using a post-tax discount rate (and post-tax cash flows), with the implied pre-tax discount rate being disclosed in the financial statements.