Companies with a 31 December reporting deadline should have started preparing for impairment testing again. This update provides a quick look at how rates have moved since 31 December 2014. It will be followed by a more detailed analysis of the appropriate parameters to use as at 31 December 2015 shortly after that date.

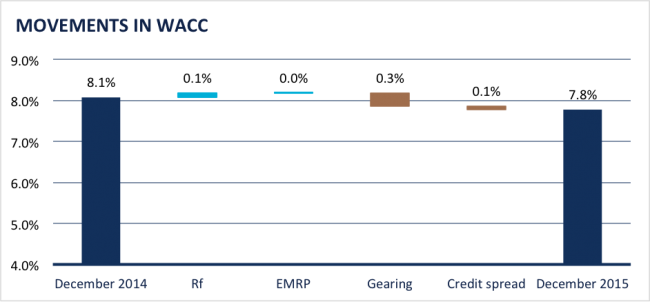

Overall discount rates have reduced slightly since this time last year, indicating increased asset values and reduced risk of impairment (assuming cash flow forecasts and other relevant factors remain unchanged). The following chart show little has changed in the key parameters required to assess discount rates.

In relation to these parameters we note as follows:

- Commonwealth Government bond yields have increased slightly over the period, but still remain at historically low levels.

- The equity market risk premium implied by market trading decreased slightly over the period. However, we have left our assessment of the equity market risk premium at 6.5% as the reduction was modest. This may initially appear counterintuitive as stock market indices also fell over the same period. However, the fall in market prices was caused by reduced earnings as opposed to increased risk aversion.

- There was no material change to market gearing levels for most industry sectors. Significant increases in gearing for the energy, staples and utilities sectors increased the overall market average from around 20% to just under 25%. This should not impact a suitable gearing assumption for most companies. The increased average gearing level for energy and staples stocks was driven by a number of large share prices declines including energy stocks Oil Search, Origin, Santos and Woodside; and staples stocks Woolworths and Metcash. The increased gearing for utilities was primarily driven by additional debt.

- Credit spreads have fallen slightly as indicated by corporate borrowing rates reported by the RBA being very slightly lower despite the increase in government bond yields noted above.

For further information on selecting an appropriate discount rate please feel free to call us.