Rising Market Discount Rates - update

Markets have increased over the last quarter as inflation has moderated but remained high. No material change has been seen in government bond yields over the last month, indicating market participates hold neutral expectations over policy rates. With market conditions continuing to evolve, we have provided an updated on our assessment of discount rates as at 31 March 2024.

Michelle Bullock, Governor of the RBA recently commented, “Inflation in Australia has passed its peak but is still too high and will remain so for some time yet. Timely indicators on inflation suggest that goods price inflation has eased further, but the prices of many services are continuing to rise briskly and fuel prices have risen noticeably of late.”

The ASX200 ended the month of March 2024 higher than 31 December 2023. With an increase in earnings largely driving this growth, this implies a stable equity market risk premium (EMRP) for Australia. We have maintained our assessment of the EMRP at 5.5% as at 31 March 2024.

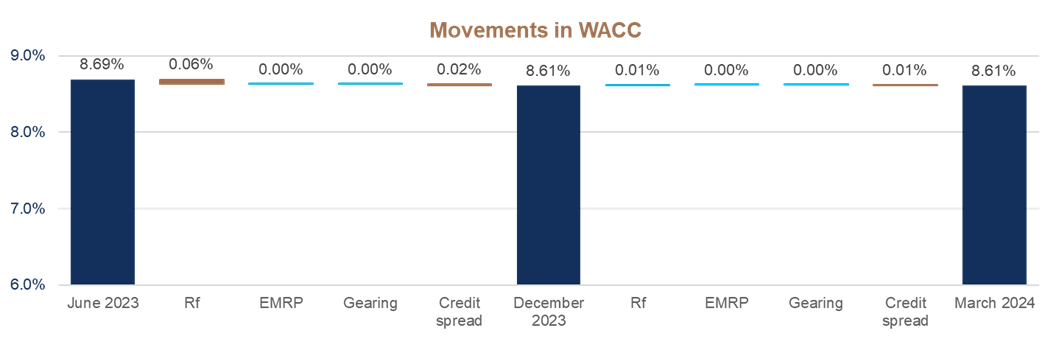

The impact of these changes on overall market discount rates is presented below.

Source: Leadenhall

With stable government bond yields and a stable equity market risk premium, overall market discount rates are unchanged from December 2023.

Companies should continue to adopt discount rates unchanged from the prior period on their valuations, whether on their investment decisions or for impairment testing.

For further information on selecting an appropriate discount rate for your company please feel free to call us.

Leadenhall Solution:

Leadenhall has provided valuation expertise and advice for more than 30 years. We specialise in the valuation of businesses, companies and intellectual property as part of:

- Independent expert’s reports for listed and unlisted public companies

- Dispute resolution and shareholder determinations

- Financial reporting including impairment assessment, intangible assets and financial instruments

- Tax compliance

- Transaction evaluation

The Leadenhall Difference:

Leadenhall doesn’t just offer thought leadership; it prides itself on knowledge delivery.

You can trust us to go beyond the maths, provide you with a deeper understanding of the assumptions made and produce a valuation that you truly understand.

That means you can proceed with certainty, safe in the knowledge that you won’t risk your reputation – or the outcome of any transformative business decision you make.